PROJECT SUMMARY

PROJECT SUMMARY

The Dumont Nickel Project held 100% by Magneto Investments L.P. is one of the largest undeveloped fully permitted and shovel ready nickel-sulphide deposits.

Dumont is a large-scale deposit located 25 km west of the town of Amos in the established Abitibi mining camp in the mining-friendly Canadian province of Québec.

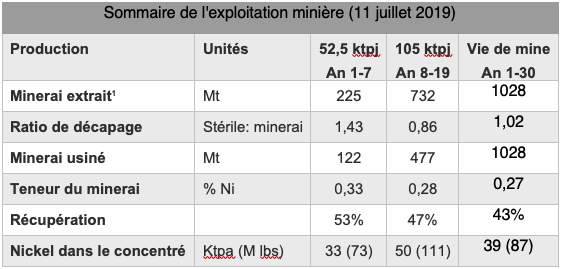

When in production, Dumont is expected to rank among the top-five largest nickel sulphide operations in the world by annual production with an average annual production of 39kt of nickel for over 30 years. – only the mining operations at Norilsk (Russia), Jinchuan (China) and Sudbury (Ontario, Canada), will be larger.

Construction and operation of the mine and processing facilities will be facilitated by the presence of excellent infrastructure, including roads, rail and access to hydro power which contribute to lowering the environmental footprint of the project.

Ores from the mine will be processed using proven, conventional methods into a high-grade nickel concentrate, and then transported for further processing elsewhere. Once in operation, the mine will produce nickel for over 30 years.

The mine will have no acid-generating rock or tailings, which has beneficial implications for environmental management.

MINING

and 9.75 billion pounds of nickel in the measured and indicated categories (measured resource of 372 million tonnes at à 0,28 % nickel and indicated resource of 1,29 billion tonnes at 0,26 % nickel).

and 9.75 billion pounds of nickel in the measured and indicated categories (measured resource of 372 million tonnes at à 0,28 % nickel and indicated resource of 1,29 billion tonnes at 0,26 % nickel).ORE PROCESSING

- Ore crushing

- Removal of fine particles (desliming)

- Flotation for roughing and purification of fines

- Roughing flotation, depletion and purification of sulphides

- Magnetic separation, regrinding and recovery of awaruite

- Concentrate Filtration Specifics of Nion Concentrate The concentrate produced at Nion will be a metal powder with a high nickel content of 29%. It will also contain 0.9% Cobalt, 1.4g/t Platinum and 3g/t Palladium.

PROJECT ECONOMY

The Dumont deposit contains approximately 6.1 billion pounds of nickel in the proven and probable reserve categories (a proven and probable reserve of 1,028 million tonnes at 0.27% nickel). This reserve is contained within a mineral resource that contains 9.75 billion pounds of nickel in the measured and indicated categories (a measured resource of 372 million tonnes at 0.28% nickel and an indicated resource of 1.29 billion tonnes at 0.26% nickel).

In the inferred resource category there is approximately 2.9 billion pounds of nickel (500 million tonnes at 0.26% nickel).

1. Nickel price assumptions are based on the average of forecasts for a panel of two independent external nickel industry analysts. The price assumption for cobalt, platinum and palladium are based on forecasts from Consensus Economics Inc.

DUMONT PROJECT

PROJECT SUMMARY

The Dumont Nickel Project is one of the largest undeveloped, shovel-ready nickel sulfide deposits and received its major environmental permits.

The Dumont Nickel Project is a large-scale project located 25 km west of the town of Amos in the well-established mining region of Abitibi in Quebec. The mineral reserve is estimated at over 1 billion tonnes with a grade of 0.27% nickel and 107 ppm cobalt.

Once operational, this reserve will ensure an average annual production of 39 kt of nickel for a lifespan of over 30 years, creating approximately 500 skilled and well-paid jobs. This production could supply enough nickel to build around 780,000 electric vehicles per year.

The Dumont Nickel Project has the potential to be key in supplying nickel for Quebec’s battery industry.

The construction and operation of the mine and processing facilities will be facilitated by excellent infrastructure, including road and rail networks and a supply of hydroelectric power, which will help reduce the project’s environmental footprint. The waste rock and tailings will be non-acid generating, which is also a significant environmental advantage. The project’s carbon footprint is further reduced by the tailings’ ability to spontaneously sequester carbon.

With an initial capital expenditure of $2.0 billion and annual economic benefits of around $300 million in parts and services, the Dumont Nickel Project will be beneficial for both the local economy and that of Quebec as a whole.

The Dumont Project at a Glance

An environmentally responsible mining operation that benefits Quebec’s economy, with the best ESG credentials.

An average production of 39,000 tonnes of nickel per year in the form of sulfide concentrate at an operating cost in the second quartile.

Can supply nickel and cobalt for approximately 780,000 electric vehicles per year. Investors are interested in Dumont for its responsible extraction of nickel with a low carbon footprint.

A mine with a long lifespan of 30 years and sustainable benefits for communities, including the creation of an average of 500 jobs through a $2.0 billion investment.

Social Acceptability: Ongoing engagement with host communities and an impact and benefits agreement with its Abitibiwinni First Nation partners.

The Dumont Project has already undergone a review by the BAPE and has obtained its environmental certificate of authorization.

Construction decision in 2025 with nickel production expected to start in the second quarter of 2028.

The battery supply chain

The Dumont Project will play a critical role in the supply of nickel and cobalt raw materials.

Project: Low Carbon Footprint

Dumont will be one of the lowest carbon footprint nickel operations in the world.

- Dumont will generate only 2.1 kg CO2 per kg of nickel (Scope 1 and 2) thanks to Quebec's renewable energy.

- Increased mine electrification to reduce diesel consumption and GHG emissions by about one-third (Trolley).

- GHG emissions directly related to site activities (Scope 1) are offset by the sequestration potential of tailings and waste rock.

CO2e Curve for the Nickel Industry 2035E

Illustration of Carbon Sequestration in Tailings and Waste Rock

Progress of Concentrate Value Addition

- Bulk sampling (January 2023) on the Dumont project site and processing of the extracted rock to produce nickel concentrate.

- Laboratory test results: The leaching of the concentrate allows for good recovery of nickel and cobalt (>97%) and produces a mixed hydroxide precipitate (MHP) containing over 45% nickel and cobalt, a sufficient grade to supply the battery industry.

- This work was carried out in 2020-21 with the support of the MEIE Innovation and the MRNF PARIDM programs.

- Continuation of work in 2024 by NiVolt to support a feasibility study for the commercialisation of the process .

- NiVolt is evaluating sites in Quebec that could host a new processing facility.

Favorable Context for the Dumont Project

- The energy transition (use of technology emitting less greenhouse gases) is accompanied by an increase in the demand for strategic minerals including nickel, cobalt, lithium, and graphite.

- Global nickel usage projections forecast that the share of nickel dedicated to batteries will double between 2021 and 2040.

TECHNICAL DOCUMENTS

Dumont Feasibility Study Technical Report (Dec, 2019)

Dumont Feasibility Study Bernier, S. and Leuangthong, Appendices

Dumont Feasibility Study Marois, J. and Mineral Solutions, Appendices

Dumont Feasibility Study Verret and Imeson, Appendices